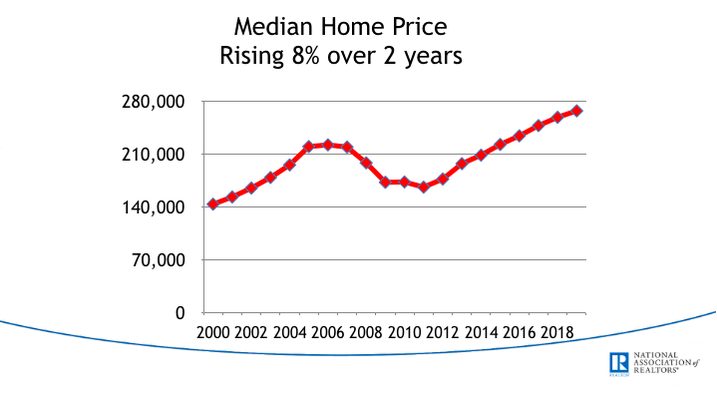

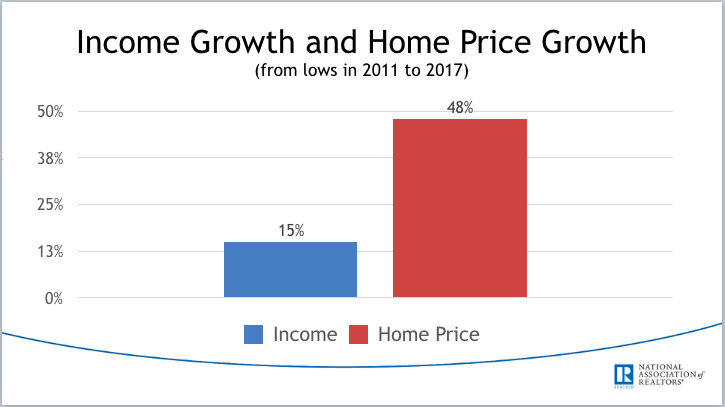

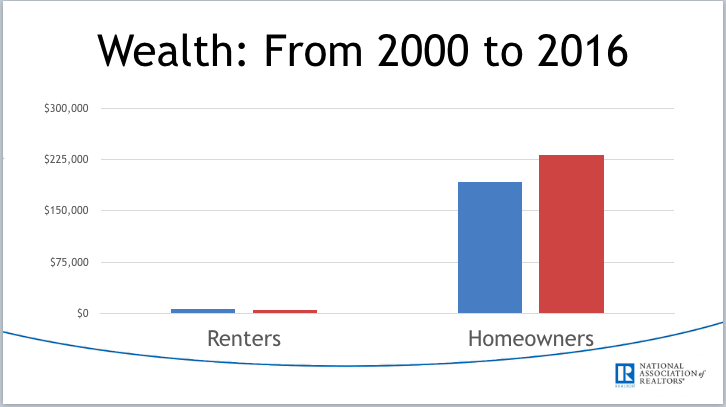

Fundamentals are saying that there is nothing to suggest we are due for a recession." - Lawrence Yun on real estate projections in Colorado Recently, I had the pleasure of attending the Economic and Real Estate Outlook lunch hosted by the South Metro Denver Realtor's Association (SMDRA). The presenter was Lawrence Yun, PhD, the Chief Economist for the National Association of Realtors (NAR). He was able to provide some great insight into the questions that're on everyone's mind: are we in a bubble and is it going to burst? The short answer to those questions: no and no. Because of the steady rate of increase in population in Colorado, and the slow rate at which housing construction and sales are striving to catch up with that number, we will not be seeing a "bubble" or a "burst" anytime soon. In fact, it is projected that home prices will continue to rise in Denver for at least the next 10 years. Furthermore, Yun included some impressive facts about the state of Colorado's and the nation's economy. Here are just a few:

Next time you're in a traffic jam just be thankful! It's because of your good economy." - Lawrence Yun, on Colorado's current economic state

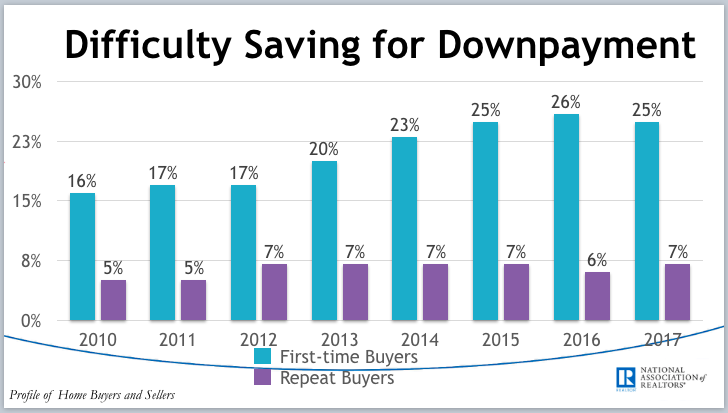

A lot of this may seem scary to someone who doesn't think they can afford a home. However, buying your first home is significantly more affordable than you think. It is a myth that one needs at least 20% to buy a home. In fact, some loans will allow a first time homebuyer to put just 1% down on their home. Additionally, down payment assistance programs and (of course) Equity for Educators if you're a teacher can help you pay the other up front costs of a home. I recently got a client into her first condo for less than $2,000. She received a check back from her lender at closing rather than paying more money.

0 Comments

Leave a Reply. |

Author Emily Baker has been an educator in North Denver since 2012. She taught 4th grade for many years, before transitioning to Middle School English. She loved her job working with children, and now her job as a realtor. With Equity for Educators she is able to combine these two passions. Archives

October 2018

Categories |

RSS Feed

RSS Feed