But What About the Other Costs?

Sure, the Equity for Educators discount helps, but what about the other up front expenses like down payment? With the right combination of minimum down payment loan, down payment assistant program, and the Educator discount, you could walk into closing with only a small fraction of the cost to pay. These are just a few of the options that are out there.

|

Loan Options1. FHA Loans: The Federal Housing Administration offers a home loan for first time home buyers that requires as little as 3.5% down on a home purchase. For this loan option you must have at least a 580 credit score or higher, have a documented verifiable income, and the home must be your primary residence. In addition, you will have to pay for Mortgage Insurance on this kind of a loan. All of that will be factored into your loan estimate by your lender however, so those costs will not be a surprise at closing.

2. Conventional Home Ready Loans: Conventional loans offer as low as a 3% down payment option. You can be a first time or repeat home buyer for these loans, and your down payment funds are not required to be your own money. They can be "gifted" to you by a friend or relative. Borrowers are also required to pay Private Mortgage Insurance on Conventional Loans, but that insurance is cancelled after 80% of the loan has been paid off. Borrowers are required to take a Home Ready Class in order to qualify. Don't worry! It's very helpful. It teaches you the basics of mortgages, home buying, and home ownership. |

Down Payment Assistance1. CHFA: The Colorado Housing and Finance Authority wants to help you pay for your first home. They will pay up to 4% of the cost of a first home, if your income doesn't exceed a certain amount. Borrowers are only required to be able to bring $1000 to the table for the CHFA program.

2. Metro Mortgage Assistance Plus: They will also pay up to 4% of the cost of your home. You never need to pay this amount back and your income must be less than $95,880 for a 2 or fewer person household. For this program also, you may be required to bring .5% the cost of your home to the table in order to qualify. 3. NHF Sapphire: Another Down Payment Assistance program is provided by the National Housing Federation. This grant does not need to be repaid, is not limited to first time homebuyers, and is offered on FHA, VA, and USDA loans. The NHF will pay up to 5% of the cost of your home. Similar to the other programs, this is for low- to moderate- income borrowers. |

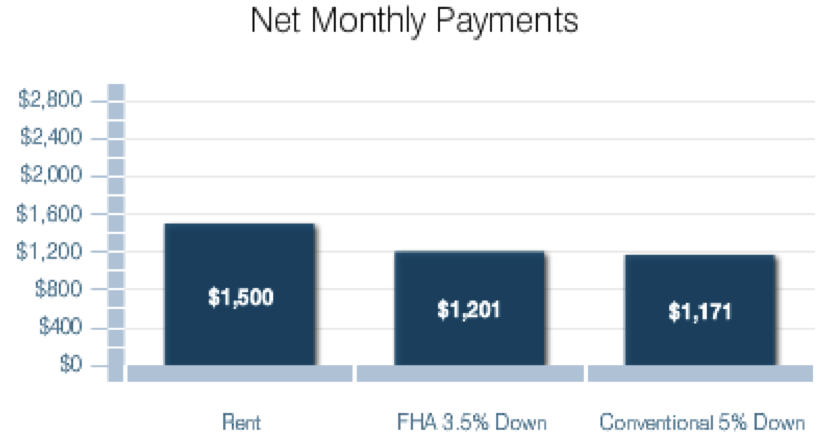

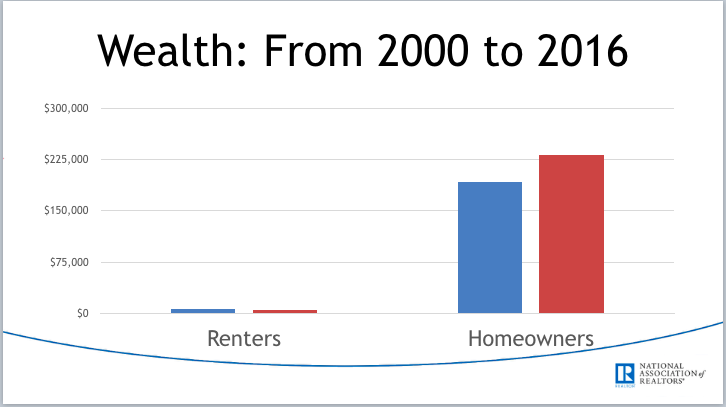

So what would buying a home really look like financially?

For more information on any of these loans or down payment assistant programs, reach out to me today! I work with a variety of lenders who are all familiar with these programs, and would be happy to help you find the payment program that is best for you.

* Based on a $250,000 home purchase and a qualified home buyer.