|

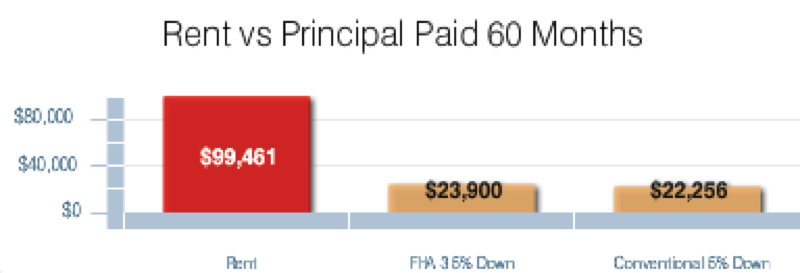

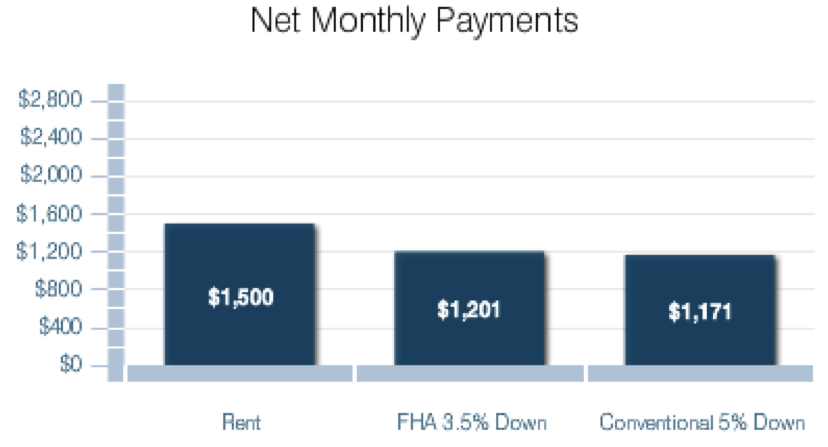

Before getting my real estate license, I was a full time teacher working in a restaurant on the weekends just to pay my bills. I had moved to Englewood where I could actually live for less than $1000 a month, and had about $6000 in savings. I was laboring under the common misconception that I could not afford to buy a home on my teacher salary. FALSE. If only I had known that one of the simplest solutions to all of these financial problems was to purchase my home! My best friend (and now real estate partner) had been telling me this for years, but I didn't believe her. Turns out, she was right! Based entirely off of my teacher salary I purchased my condo. My monthly payments are lower, and I'm saving even more money because I rent out my second bedroom! Lori Richardson, one of the amazing lenders I work with, put together the above charts reflecting monthly costs and overall savings over 5 years for a purchase of $250,000. They show (at least) a $300 monthly savings based on current rent trends in the Denver area. Furthermore, over 5 years instead of spending almost $100,000 in rent, you would have accrued almost $24,000 in equity! But I'm sure you're still wondering how you do this. Here are just a few ways home buying is more affordable than you thought:

0 Comments

|

Author Emily Baker has been an educator in North Denver since 2012. She taught 4th grade for many years, before transitioning to Middle School English. She loved her job working with children, and now her job as a realtor. With Equity for Educators she is able to combine these two passions. Archives

October 2018

Categories |

RSS Feed

RSS Feed