|

You'd be surprised what actually falls in a teacher's price range in Denver. There is much more available than one might assume! Teachers earning at least $40,000 a year with good credit should qualify for at least $200,000 in a loan. This amount will differ from person to person, but every teacher I have worked with has been qualified for at least this amount. In addition, a second bedroom in this price range can be rented out to pay off most if not all of your monthly mortgage payment! Here are a few properties in Denver that one can get within that price range:

If these or any other properties interest you, contact Equity for Educators right away! I'd be happy to take you to see it anytime.

0 Comments

We all know quite well that we love our jobs as teachers. If that weren't true, there would be no teachers! The enjoyment we get out of transforming lives, the day to day versatility of our job, and the time spent with entertaining and brilliant young people is certainly rewarding. However, the financial rewards don't compare and are making it more and more challenging for school districts in the United States to recruit and retain teachers. Here are just a few realities teachers across America are facing:

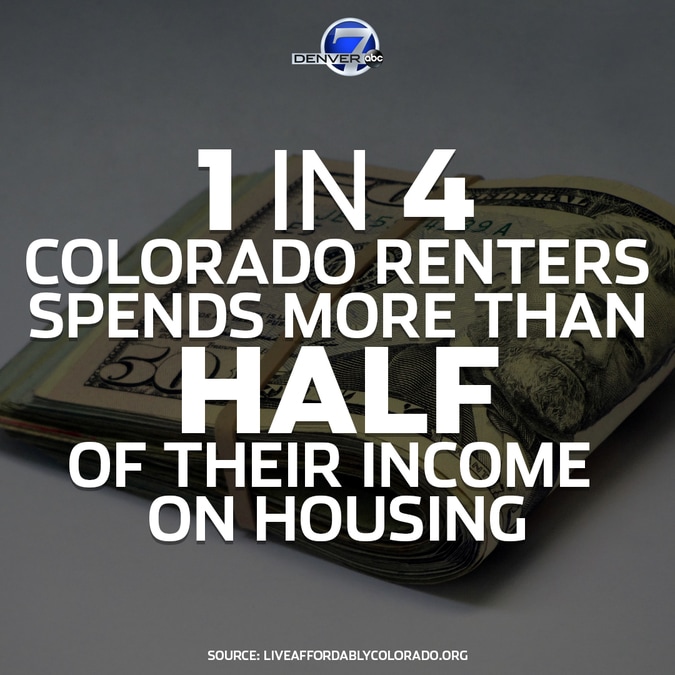

These numbers are very disheartening. Not only do they show the challenging financial realities of being a teacher, but also the decline of the profession overall. On the bright side, if you can see one, 98% of people say that a teacher has the power to change a person's life. Last week I had the honor of speaking at the Colorado Educator Housing Summit. The Summit was put on by Paula Davis, a fellow with the Donnell-Kay Foundation, to address the growing issues of teacher salary and teacher retention. As outlined in the report that spurred the Summit titled "Affordable Housing Solutions for Teachers," the average rent for a one-bedroom apartment in Denver is $1350 while average teacher salary is $50,250. While I have heard that statistic before, I certainly don't know any teachers making even close to that much. I fought tooth and nail to get $40,000 my final year as a full time teacher. While I was privileged enough to get to present about Equity for Educators, there were also five other panelists and a representative from the Denver Mayor's Office discussing the other efforts being made to help teachers afford housing. Here's what they are all working on:

Not only was I so excited to get to present at this event, but I was thrilled to see all of the efforts being made both in the rental and ownership arenas for teachers. Email me directly if you would like to see a copy of the affordable housing report.

When I embarked on my own home buying adventure, I was already intimately familiar with the real estate process thanks to my profession. However, I was not as familiar with the lending process. There are a few things I wish that I had known going into it, and I would like to share those with you.

All of these factors will play in to how they determine the maximum amount that they can lend to you. They will then give to you a Prequalification Letter which you and your Realtor can present with every offer you make on a house. 2. During the Process After you have had your offer on a property accepted you are "Under Contract." While you are under contract there are a number of things that you cannot do. This is where the parts start to come in that no one ever told me and I wish they had. First, you do not want to spend any amount of money on your credit cards. Cash is your best friend while you are under contract. As a teacher on a strict budget, this was hard for me to do. I rely heavily on my credit cards when times are tight. Be sure that you have budgeted for this ahead of time.

3. Closing Costs

After you've gone through the entire lending process, having spent absolutely no money for 30-45 days you will have closing costs. This is the big part that I wish someone had told me prior to budgeting for my home. I knew that I would have to pay the rest of my down payment, however on average a buyer has to pay an additional $3000-$7000 in lender closing costs according to Zillow. These numbers will be laid out for you in a Loan Estimate that your lender will give you after going Under Contract on a house, but just be aware prior to the purchase process that these costs exist. Though the lending and buying process can be stressful, you have a real estate agent and a lender there to help guide you. It is their job to alleviate any concerns you have during that time, so don't hesitate to ask. And, when it is all said and done, you will own your own home! That is a great reward indeed. I think we all know what the end of the school year is like for teachers. It is a whirlwind of grading, activities, parties, more grading, and continuations/graduations/any-kind-of-ations. This blog post has been on my to do list for going on a month now, but of course the 40 essays and 54 finals I had to grade, the 40 report card comments I had to write, the talent show I had to plan, and the graduation speeches I had to write took precedence.

It was such an honor to see those kids, who I had seen grow up from the age of 9 to 14 or 15, graduate and head on to many amazing high schools. When I finally had that moment to reflect I remembered, in spite of grading almost a hundred papers, writing a few dozen report card comments, speeches, and organizing an all school event in the span of three days, this job is worth it. That is why I do what I do on both fronts: because teaching is extremely rewarding emotionally, but needs more rewards financially.

And so, just week one week out of school for the year, I am already planning an anxiously awaiting the next school year in August. I hope you all are feeling the same! Currently Denver apartment rents are among the nation's least affordable for teachers. Last week, my Price & Co partner and I were able to attend the Affordable Housing Forum hosted by All In Denver at the Mercury Cafe. The Forum sought to review the results of a recent poll of Denverites with the audience and then to answer any questions that arose. The poll revealed that concerns for housing were peak among Denver voters, exceeded only by education. 32% of people said they would like the Mayor and City Council to address education, 30% said affordable housing, 30% also said homelessness, and 19% said cost of living. These were the top five concerns as shown by the poll. People have a right to have housing, and have a right to pay for groceries, medical bills, etc. Meanwhile, rent prices continue to rise and Denver voters have great concern about certain rights that landlords maintain. Currently, there are no caps on application fees and so Landlords have the ability to profit off of them. Some low-income renters can pay upwards of a month's worth of rent on application fees alone before even being approved for a place to live. In addition, landlords can evict without good cause, and vouchers and government assistance are not allowed to be taken as financial qualifications for an application. This leaves a tremendous amount of low-income Denver residents without a way to qualify for housing. Most renters' rights bills addressing these issues died before being able to be passed.

What can we do? It's great that people are concerned, but that is only the first step. In order to enact change we must make change happen. At the Forum we were urged to reach out to our city council members and local government officials and push them to take action. In addition, supporting organizations like All in Denver can go a long way.

Another great option is to explore purchasing a home. Though to some it may seem like an unrealistic goal, minimum down payment loans and down payment assistance grants can help overcome the hurdles of high rents and low income. But the bottom line is we all have to do something in order to make anything happen. To learn more about All in Denver or the Affordable Housing poll check out their website. As an educator in Denver I thought that I would be a renter for the rest of my life. The concept of saving for a down payment seemed like a pipe dream. I watched as many of my friends achieved the American Dream of purchasing real estate in neighborhoods like South Broadway, Capital Hill, and the Highlands. Meanwhile, rent prices were continuing to rise and I had to move further south where one bedroom apartments could still be found for under $1000 a month.

My career in real estate opened up a whole new realm of possibility for me. It introduced me, firstly, to minimum down payment loans. This means that on my $210,000 condo I only needed to come up with $6000 to purchase it. Now I know what you're thinking, $6000 is still a lot of money. That is where Down Payment Assistance comes in. As a realtor I was able to apply what would have been my commission to the bulk of these up front costs, but a Down Payment Assistance program would serve the exact same purpose. What's the catch? There is no catch! The government has created these programs because they WANT you to own a home.

|

Author Emily Baker has been an educator in North Denver since 2012. She taught 4th grade for many years, before transitioning to Middle School English. She loved her job working with children, and now her job as a realtor. With Equity for Educators she is able to combine these two passions. Archives

October 2018

Categories |

RSS Feed

RSS Feed